Supporting Homeownership and Homeowners

One of the most important goals of CSNDC’s Real Estate Development efforts is to enable residents to purchase a home. We offer a wide variety of services to give people the knowledge and resources necessary to buy and maintain a home. We also help families stay in their home. From educational programs for first-time buyers to support for home repairs and foreclosure prevention, CSNDC is here to help.

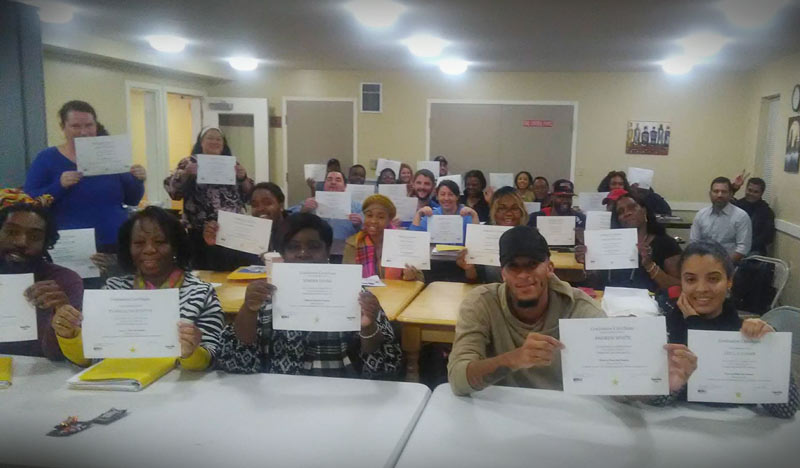

First Time Homebuyer Education

Buying a new home can be scary and daunting, but learning how to do it doesn’t have to be. CSNDC helps residents in the Codman Square area develop the knowledge and skills necessary to successfully purchase and maintain a new home through workshops and online learning.

CSNDC’s First-Time Homebuyer education workshops aim to put aspiring homeowners on a successful pathway to sustainable and affordable homeownership. The workshop covers:

● An overview of the homebuying process

● The role of budget and credit

● The mortgage application process

● Top ten questions you should ask your home inspector

● Why work with a real estate agent

● Why you need your own real estate attorney

● How to shop for home insurance

● The responsibilities of home ownership

CSNDC also offers access to “Framework,” an online homebuyer education course developed by the Housing Partnership Network and the Minnesota Homeownership. Certificates are issued to those who complete the course and complete a counseling session with CSNDC staff. This is ideal for individuals who prefer to learn at their own speed.

In addition, CSNDC offers one-on-one and group homebuyer education training and counseling to aspiring homebuyers.

We offer two ways to access First Time Homebuyer Education:

Home Rehab Loan Program

Many homeowners in our community confront a seemingly insurmountable challenge when it comes to the repair and maintenance expenses related to their homes because banks tend to shy away from making loans to low- or moderate-income homeowners.

In 2018, Massachusetts passed a law permitting nonprofit agencies to make home repair/maintenance loans to low- and moderate-income families. CSNDC has taken this opportunity to create our Home Rehab Loan Program, which supports homeowners who need help to make core repairs and improvements to their home.

In an innovative configuration of roles, CSNDC uses funds generated independently and allocated for home improvements to make loans available at below-market rates to qualifying families. We will then contract with a financial institution to manage the loan origination/lending process and to serve as the formal financial manager and loan servicer for this new lending practice.

Rebuilding Together Boston Home Repair

CSNDC has partnered with Rebuilding Together Boston (RTB) to offer critical repairs at no cost to selected lower-income homeowners in and around Codman Square as part of our larger effort to counter the impacts of displacement, particularly among aging Dorchester residents.

This unique program mobilizes volunteers, skilled workers, tradespeople, and community members who work together to address costly deferred maintenance issues. If not corrected, these issues can lead to unsafe and unhealthy homes that may make homeowners more susceptible to advances and below-market offers from unscrupulous real estate speculators.

The RTB program is an alternative to unsafe or unrepaired homes, as well as an alternative to selling for those at-risk of such speculative pressure. It is also an important piece of CSNDC’s anti-displacement strategy to ensure our residents can remain in our community as we face increased gentrification. Since the beginning of the partnership between CSNDC and RTB, we have repaired the homes – and lives – of approximately two dozen homeowners.

Foreclosure Prevention

CSNDC has established a Mortgage Foreclosure Prevention program as part of our larger strategy to reduce resident displacement in the Codman Square area. Foreclosure prevention is a powerful tool for protecting a community from displacement and preserving community wealth.

When life’s uncertainties and hardships cause a homeowner to be unable to keep up with their monthly mortgage payments, CSNDC advocates to financial institutions on behalf of the homeowner to help the homeowner understand their options and take the most favorable course of action. This may include debt restructuring, loss mitigation, and individual financial counseling to avoid foreclosure.

In 2019, CSNDC’s foreclosure prevention work saved 26 greater Boston-area homes, representing 43 households, from foreclosure. This retained $15 million in market value in the hands of residents. The preservation of personal wealth through ownership of capital is a foundational form of economic power and an essential ingredient in our ongoing effort to prevent displacement of Codman Square’s historic community.